05 Jan 4 Reasons Fracking Could Surge in 2018

2017 was an encouraging year for the American hydraulic fracturing industry. Crude prices more than doubled since 2016, domestic production steadily increased, and the economy at large boomed.

What does the forecast look like going forward into 2018?

The short answer: it looks like fracking could surge in 2018.

These are just a few of the reasons why:

Oil Prices

Crude prices have reached the highest level since June of 2015 at more than $60 a barrel, and it looks like prices should be consistently strong throughout 2018.

Crude prices have reached the highest level since June of 2015 at more than $60 a barrel, and it looks like prices should be consistently strong throughout 2018.

With OPEC’s cuts to production to continue throughout 2018, domestic producers can enjoy a little more security in their investments into new production. The higher oil prices we’ve enjoyed since OPEC have been highly beneficial for American energy companies.

China’s strong demand for oil is another great sign for rising oil prices over the next year. In November, the country’s crude inventories dropped to a seven year low, leading to increased import quotas for 2018. These signs point to steady prices.

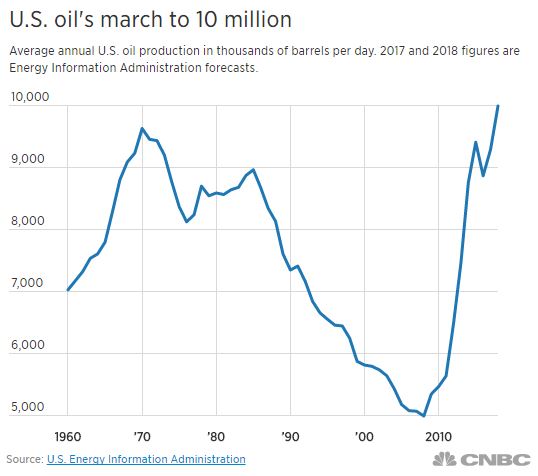

Record US Oil Production

Image credit to CNBC

The US Energy Information Administration has projected 2018’s domestic production to hit a record level of 10.02 million barrels/day, topping 1970’s mark of 9.6.

Efficiency has helped tremendously. According to Tamar Essner, energy director of Nasdaq Advisory Services, “any dollar invested today [in fracking] is double as efficient as it was two years ago.”

Production in the Permian rose nearly 30% from 2016-2017, and the rig count almost doubled. This frantic activity in the area—815 million barrels this year—will make up a huge portion of the new record production, projected to be 43.6% of US production in 2018.

Frac Sand

Despite rising sand costs, there are good signs for sand in 2018—especially in the Permian Basin.

Despite rising sand costs, there are good signs for sand in 2018—especially in the Permian Basin.

Local Permian sand should become even more accessible, with facilities opening throughout 2018 by Atlas Sand, Hi-Crush, US Silica, and others. Atlas alone aims to add 6 million tons of sand per year to supply in 2018, and should start delivering sand by February.

With sand costs increasing, innovation in the market will be continuing into the new year. One firm, PanXchange, hopes to optimize the frac sand market by opening a commodity exchange to help streamline sand acquisition and trading.

Additionally, our team at Dragon has been developing frac sand transportation solutions to improve last mile delivery logistics and reduce the overall costs of sand transport, storage and delivery. The Dragon Sand Pod I is a portable roll-off container that can be staged quickly and can offload to blender hoppers via pneumatic air, blowing aloft or a gravity based system. Most recently we introduced the Sand Force, a trailer mounted system with bottom discharge that can unload 25 tons of sand in approximately 11 minutes- a vast improvement over traditional pneumatics and friendlier to the environment as well.

Friendly Presidential Administration

President Trump’s administration is slashing regulations on the industry. On the 29th of December, the Interior Department rolled back an Obama-era rule limiting fracking on public lands. Although the rule hadn’t gone into effect, it would have added massive regulatory costs for the industry—as much as $34 million per year.

President Trump’s administration is slashing regulations on the industry. On the 29th of December, the Interior Department rolled back an Obama-era rule limiting fracking on public lands. Although the rule hadn’t gone into effect, it would have added massive regulatory costs for the industry—as much as $34 million per year.

The Trump administration’s Bureau of Land Management plans expansion of public land lease sales for energy production. Nearly 1 million acres in the first half of 2018 should become available to producers.

More boons for the industry are on the horizon as well.

Trump promises to place continuing energy deregulation high on his agenda for 2018. And Department of Energy secretary (and former Texas governor) Rick Perry plans moves to enable more natural gas exports in 2018. It’s clear that the president’s energy policy should help continue the rise of fracking in 2018.

Oil prices should remain strong. Production looks to continue rising. The sand market is full of innovation. And the government is finally set to promote domestic production. It definitely looks like a great climate for the frac industry in 2018.

Sources: http://money.cnn.com/2017/12/26/news/oil-prices-libya/index.html | http://www.cbc.ca/news/business/opec-meeting-vienna-1.4426173 | https://www.reuters.com/article/us-global-oil/oil-prices-stay-near-high-on-strong-u-s-refinery-runs-china-data-idUSKBN1EM04P | https://www.reuters.com/article/us-usa-oil-eia-outlook/eia-raises-2018-u-s-oil-output-forecast-to-highest-on-record-idUSKBN1E62IP | https://www.eia.gov/petroleum/drilling/ | https://oilprice.com/Energy/Crude-Oil/Permian-Beats-Own-Record-In-Oil-Production.html | http://money.cnn.com/2017/03/08/investing/record-us-oil-production-eia/index.html | https://www.cnbc.com/2017/06/06/us-oil-output-to-hit-record-10-million-barrels-a-day-next-year-eia.html | https://www.bizjournals.com/austin/news/2017/12/27/austin-company-backed-by-energy-veterans-millions.html | https://www.freightwaves.cOom/news/2017/12/12/panxchange-enters-us-market-with-designs-on-simplifying-movement-of-frac-sand | https://www.ft.com/content/dcf29ad8-da99-11e7-a039-c64b1c09b482 | https://www.washingtonpost.com/news/energy-environment/wp/2017/12/29/to-round-out-a-year-of-rollbacks-the-trump-administration-just-repealed-key-regulations-on-fracking/ | https://climatewest.org/2017/12/13/public-lands-giveaways-for-fracking-set-to-double-in-size-in-2018/ | https://www.theenergylawblog.com/2017/03/articles/environmental/trumps-doi-to-repeal-fracking-regulations-for-federal-lands/ | http://www.washingtonexaminer.com/daily-on-energy-energy-deregulation-high-on-trumps-2018-agenda/article/2177060

Sorry, the comment form is closed at this time.